Difference Between Proforma Invoice and Tax Invoice 2026

For many Indian businesses, invoicing looks simple on the surface but becomes confusing the moment compliance, GST, and real transactions enter the picture. Terms like proforma invoice and tax invoice are often used interchangeably, especially by small businesses, startups, freelancers, and even growing MSMEs. This confusion usually does not come from lack of effort, but from the way businesses learn invoicing on the job rather than through formal training. In day-to-day operations, invoices are created quickly to close deals, raise payments, or share estimates, and the finer legal distinctions are often overlooked until a problem arises.

In real business scenarios, proforma and tax invoices get mixed up at very common touchpoints. A client asks for an invoice before releasing an advance, and a business sends a tax invoice too early. A vendor issues a proforma invoice, but the buyer tries to claim GST input credit on it. During audits or GST return filing, businesses realise that the document they issued or received does not legally support the transaction the way they assumed. These situations are not rare. They happen regularly across service providers, traders, exporters, and even well-established companies.

Understanding the difference between a proforma invoice and a tax invoice is not just about terminology. It directly affects GST compliance, cash flow planning, client trust, and audit safety. This article breaks down that difference clearly, using practical Indian business contexts, so you know exactly which invoice to use, when to use it, and why it matters.

What Is a Proforma Invoice

Meaning Explained in Simple Terms

A proforma invoice is a preliminary bill shared by a seller with a buyer before the actual sale takes place. In simple words, it is a formal quotation that shows what the seller intends to supply, at what price, and under what terms, but it is not a final demand for payment.

From real business experience in India, a proforma invoice is often used to align expectations. It helps both parties agree on pricing, quantities, taxes (if any), delivery timelines, and payment terms before committing to a legally binding transaction. Think of it as a written confirmation of “this is what the deal will look like if we proceed.”

It does not confirm a sale, does not create a tax liability, and does not replace a tax invoice.

Practical Business Use Cases in India

In day-to-day Indian business operations, proforma invoices are extremely common across industries. Some practical situations where businesses regularly use them include:

- Advance payment requests

Many Indian vendors issue a proforma invoice to request an advance before starting work or dispatching goods. - Client approvals and internal sanctions

Companies often need a proforma invoice to get internal approvals from finance teams or management before releasing funds. - Exports and international trade

Exporters use proforma invoices for customs documentation, foreign buyer confirmation, and bank formalities such as LC processing. - Large or customized orders

When pricing depends on specifications, volume, or customization, a proforma invoice helps lock terms before execution. - Freelancers and service providers

Independent professionals frequently share proforma invoices to confirm scope and pricing before onboarding a client.

In all these cases, the proforma invoice acts as a planning and confirmation document, not a legal proof of sale.

Key Characteristics of a Proforma Invoice

Based on real invoicing practices followed by Indian businesses, a proforma invoice typically has the following characteristics:

- Issued before goods are supplied or services are rendered

- Looks similar to a tax invoice but clearly marked as “Proforma Invoice”

- Used mainly for quotation, confirmation, or advance collection

- Does not carry legal enforceability like a tax invoice

- Not required to follow strict GST invoice numbering rules

- Can be revised or cancelled without compliance consequences

Although it may mention expected taxes for clarity, it remains a non-binding document until converted into an actual tax invoice.

Is GST Applicable on a Proforma Invoice or Not

This is where many Indian businesses get confused.

GST is not applicable at the proforma invoice stage.

Issuing a proforma invoice does not create a GST liability by itself.

Under GST law, tax liability arises only when:

- Goods are supplied or services are rendered, or

- A tax invoice is issued, or

- Payment is received in certain cases (as per time of supply rules)

A proforma invoice is only an intention document. It is not reported in GST returns, does not allow input tax credit, and cannot be used for compliance or audit purposes.

However, once the transaction moves forward and payment is received or supply is made, the seller must issue a proper tax invoice and charge GST as applicable.

What Is a Tax Invoice

A tax invoice is the most important billing document under India’s GST system. In simple terms, it is the legal proof that a taxable supply of goods or services has taken place and that GST has been charged correctly. For Indian businesses, issuing a tax invoice is not just a routine accounting step. It is a statutory requirement that directly affects compliance, audits, and the ability of customers to claim input tax credit.

From practical experience, most GST notices and disputes arise not because tax was unpaid, but because tax invoices were issued incorrectly, late, or with missing details. This makes understanding tax invoices critical for every registered business.

Meaning of Tax Invoice Under GST Law

Under the GST framework, a tax invoice is a document issued by a GST-registered supplier to a buyer for the supply of taxable goods or services. It must contain prescribed details such as GSTIN, invoice number, date, taxable value, GST rate, and tax amount.

In day-to-day business terms, a tax invoice confirms three things:

- A supply has legally occurred

- GST liability has been created for the seller

- The buyer is eligible to claim input tax credit, subject to conditions

Unlike estimates or proforma invoices, a tax invoice has full legal standing and is directly linked to GST returns like GSTR-1 and GSTR-3B.

When Does a Tax Invoice Become Mandatory

Issuing a tax invoice becomes mandatory once a taxable supply is made by a GST-registered person. The timing depends on whether the supply is of goods or services.

In practice, a tax invoice must be issued:

- At the time of removal or delivery of goods

- Before or after providing services, within the GST-prescribed timeline

- Whenever GST is charged to the customer

Once GST is charged, the document cannot be a proforma invoice or quotation. It must be a tax invoice. Many businesses make the mistake of raising a proforma invoice, collecting payment, and delaying the tax invoice. This often leads to compliance mismatches during GST reconciliation.

Legal and Compliance Importance of a Tax Invoice

A tax invoice is not just a billing document. It is a legal record that connects sales, tax payment, and return filing.

From a compliance perspective, tax invoices are essential for:

- Accurate GST return filing

- Avoiding penalties for delayed or incorrect invoicing

- Supporting transactions during GST audits and assessments

- Proving turnover, revenue, and tax liability

If a tax invoice is missing, incorrect, or not reported properly, it can result in:

- Disallowance of input tax credit to the buyer

- GST notices and penalties for the seller

- Mismatches in GSTR filings

Businesses that maintain clean and timely tax invoices usually face fewer GST-related disputes.

GST Implications and Input Tax Credit Relevance

The input tax credit system under GST revolves around tax invoices. Without a valid tax invoice, ITC cannot be claimed, even if tax has been paid.

Key GST implications include:

- GST liability arises only through a tax invoice

- Tax invoice details must match across GST returns

- ITC is allowed only when the supplier reports the invoice correctly

From real-world experience, even genuine businesses lose ITC because:

- The supplier issued an incorrect invoice

- Invoice details did not reflect in GSTR-2B

- GSTIN or tax amounts were entered wrongly

This is why tax invoices must be issued carefully, reported accurately, and preserved properly. They act as the backbone of GST compliance for both sellers and buyers.

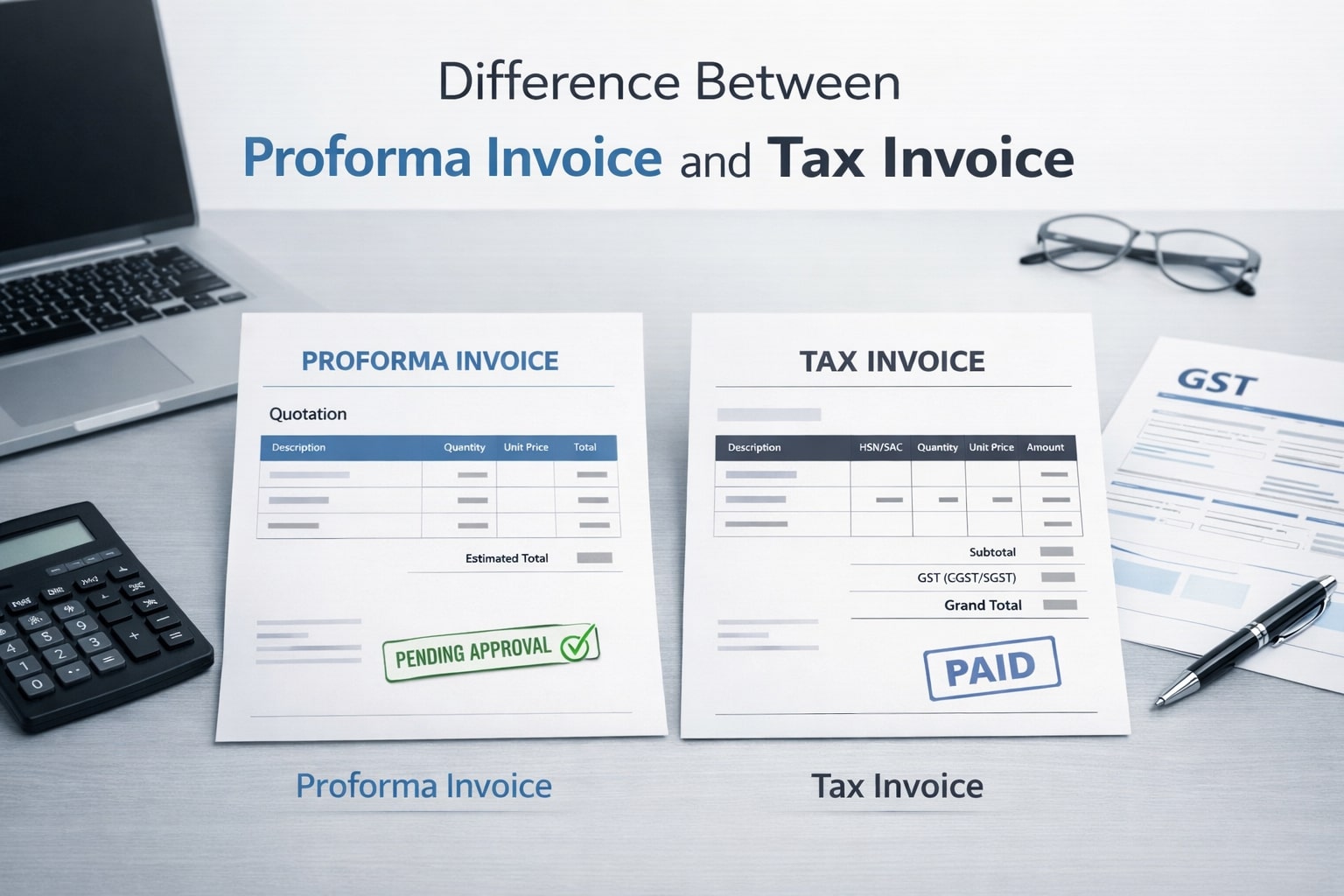

Proforma Invoice vs Tax Invoice – Key Differences 2026

For many Indian businesses, the confusion between a proforma invoice and a tax invoice starts at the billing stage itself. On paper, both documents may look similar. In practice, however, they serve very different purposes and have very different legal and GST implications. Understanding this difference is not just about documentation clarity. It directly impacts GST compliance, accounting accuracy, cash flow planning, and audit readiness.

To make this distinction clear and actionable, the table below breaks down the key differences that matter most in real business scenarios.

Proforma Invoice vs Tax Invoice Comparison Table

Aspect | Proforma Invoice | Tax Invoice |

Purpose | Used as a preliminary document to share estimated pricing, terms, and scope before a sale is finalized. It helps the buyer understand costs and approve the transaction. | Issued as a final billing document after the supply of goods or services. It is used to legally demand payment and record the sale. |

Legal Validity | Does not have legal standing as proof of sale. It cannot be used as evidence of revenue or supply during audits. | Legally valid document under GST law. It serves as official proof of supply and sale. |

GST Applicability | GST is not payable at the proforma invoice stage since no supply has occurred. It is only indicative and non-taxable. | GST becomes applicable once a tax invoice is issued. The seller must charge GST and report it in returns. |

Timing of Issuance | Issued before the sale, often during negotiation, quotation, or advance payment discussions. | Issued after goods are supplied or services are completed, or as per GST time of supply rules. |

Impact on Accounting and Returns | Not recorded as revenue in books of accounts. It does not affect GST returns or tax liability. | Recorded as income in accounting records and reflected in GST returns. It directly impacts tax liability and compliance. |

Why This Difference Matters in Practice

From real-world experience, many Indian businesses mistakenly treat a proforma invoice as a tax invoice, especially when advance payments are involved. This often leads to premature GST reporting or mismatches during GST reconciliation. On the other hand, delaying a tax invoice beyond the permitted timeline can attract penalties and compliance issues.

The key takeaway is simple. A proforma invoice supports decision-making and approvals, while a tax invoice supports legal compliance and taxation. Treating them interchangeably may seem convenient in the short term, but it can create serious accounting and GST complications later.

Common Mistakes Businesses Make

Despite dealing with invoices regularly, many Indian businesses still make avoidable mistakes that later create GST complications, cash flow issues, and audit risks. These errors usually happen due to misunderstanding the purpose of each invoice or rushing the billing process without considering compliance implications. Based on real-world business practices, here are the most common mistakes to watch out for.

Issuing Tax Invoices Too Early

One of the most frequent mistakes businesses make is issuing a tax invoice at the quotation or negotiation stage.

In practice, many businesses raise a tax invoice as soon as a client agrees in principle or asks for a cost breakup. This often happens to appear professional or to speed up payments. However, under GST, a tax invoice should be issued only when the supply of goods or services actually occurs or when GST liability is triggered.

Why this becomes a problem:

- GST becomes payable immediately once a tax invoice is issued

- The business may have to pay GST even before receiving payment

- If the deal is cancelled or modified, reversing GST entries becomes messy

- It can lead to mismatches in GST returns during audits

Better practice:

Use a proforma invoice for price confirmation, internal approvals, or advance discussions. Issue a tax invoice only when the supply is confirmed and legally taxable.

Treating Proforma Invoices as Legal Bills

Another common misconception is treating a proforma invoice as a legally binding bill.

Many small businesses, freelancers, and even startups assume that once a proforma invoice is shared, it holds the same legal and accounting weight as a tax invoice. In reality, a proforma invoice is only an estimated document, not a demand for payment under GST law.

Common consequences of this mistake:

- Recording revenue prematurely in books of accounts

- Assuming GST compliance without issuing a tax invoice

- Confusion during client disputes or payment delays

- Problems during audits when no valid tax invoice exists

Key clarity for Indian businesses:

A proforma invoice is useful for communication and planning, but it does not replace a tax invoice. GST compliance, input tax credit, and revenue recognition all depend on a valid tax invoice, not a proforma one.

GST Reporting Errors

Incorrect invoice usage often leads directly to GST reporting mistakes.

When businesses confuse proforma invoices with tax invoices, GST returns may reflect incorrect values, missing invoices, or early tax liabilities. This becomes especially risky during GSTR-1 and GSTR-3B filings.

Typical GST-related errors include:

- Reporting GST based on a proforma invoice

- Missing tax invoices in monthly returns

- Declaring outward supplies before actual supply

- Difficulty reconciling books with GST portal data

Why this matters:

GST errors do not stay hidden for long. During departmental scrutiny or audits, invoice-level mismatches can attract notices, interest, or penalties.

Practical takeaway:

Only tax invoices should be considered for GST reporting. Proforma invoices should remain outside GST returns and accounting entries until converted into a valid tax invoice.

Quick Summary for Business Owners

- Use proforma invoices for estimates, approvals, and negotiations

- Issue tax invoices only when GST liability is triggered

- Never report GST based on a proforma invoice

- Clear invoice discipline reduces audit stress and compliance risk

When businesses understand the correct role of each invoice, compliance becomes simpler, cash flow improves, and unnecessary GST complications are avoided.

Common Invoice-Related Mistakes: Comparison Table

Mistake | What Businesses Often Do | Why It Is Incorrect | Practical Impact on Business | Correct Approach |

Issuing tax invoices too early | Raise a tax invoice at quotation, approval, or negotiation stage | GST law expects a tax invoice only when supply occurs or tax liability is triggered | GST becomes payable before receiving payment, cash flow strain, reversal complications if deal changes | Use a proforma invoice for estimates and approvals; issue tax invoice only after supply confirmation |

Treating proforma invoice as a legal bill | Record proforma invoice as revenue or assume it is a demand for payment | A proforma invoice is only an estimate and has no legal standing under GST | Revenue recorded prematurely, audit issues, no valid document for GST compliance | Treat proforma invoice strictly as a non-accounting, non-GST document |

Reporting GST based on proforma invoice | Include proforma invoice values in GST returns | GST returns must reflect only actual taxable supplies supported by tax invoices | GST mismatches, notices from department, interest or penalties | Report GST only after issuing a valid tax invoice |

Assuming GST is applicable on proforma invoice | Charge or mention GST liability at proforma stage | Proforma invoice does not create GST liability | Confusion for clients, incorrect expectations, compliance errors | Clearly mention that GST applies only when tax invoice is raised |

Using wrong invoice during audits | Present proforma invoices as proof of supply | Auditors and GST officers require tax invoices for verification | Audit objections, documentation gaps, credibility issues | Maintain clear separation between proforma and tax invoices |

Decision Table: Which Invoice to Use and When

Business Situation | Use Proforma Invoice | Use Tax Invoice | Reason (Practical Explanation) |

Sharing price estimate or quotation with client | Yes | No | At this stage, the transaction is only indicative and no GST liability arises |

Client approval or internal budgeting | Yes | No | Proforma invoice helps clients get approvals without creating legal or tax obligations |

Negotiating scope, quantity, or pricing | Yes | No | Details may change, so issuing a tax invoice would create unnecessary GST complications |

Receiving advance payment before supply | Yes (initially) | Yes (at GST trigger point) | Proforma invoice can be shared for advance request, but GST applies when advance triggers tax liability |

Goods or services supplied or completed | No | Yes | Tax invoice is mandatory once supply occurs under GST law |

Claiming or passing input tax credit | No | Yes | Input tax credit is allowed only on a valid tax invoice |

GST return filing (GSTR-1, GSTR-3B) | No | Yes | Only tax invoices are legally reportable in GST returns |

Accounting revenue recognition | No | Yes | Proforma invoices should not be recorded as revenue |

Facing GST audit or scrutiny | No | Yes | Tax invoice is the only acceptable proof of taxable supply |

Deal cancelled or modified before supply | Yes | No | Proforma invoice avoids reversal issues since no GST was paid |

Recommended Reads for You

Real Business Examples With INR Values (India-Focused)

Example 1: Service Quotation for a Website Project

Detail | Information |

Business type | Digital marketing agency |

Client requirement | Website development |

Estimated value | ₹1,20,000 |

GST rate | 18 percent |

Invoice to use initially | Proforma Invoice |

Explanation:

The agency shares a proforma invoice for ₹1,20,000 plus applicable GST for client approval and internal budgeting. At this stage, no GST is payable and no accounting entry is passed.

When tax invoice is issued:

Once the website is completed or milestone is achieved, the agency issues a tax invoice. GST of ₹21,600 is charged and reported in GST returns.

Example 2: Advance Payment for Interior Design Services

Detail | Information |

Business type | Interior design firm |

Project value | ₹5,00,000 |

Advance requested | ₹2,00,000 |

GST rate | 18 percent |

Correct invoice flow:

- Proforma invoice issued for ₹5,00,000 to explain project cost

- Client pays advance of ₹2,00,000

- Tax invoice issued for the advance amount as GST is triggered

GST calculation on advance:

GST at 18 percent on ₹2,00,000 equals ₹36,000

Why this matters:

Issuing only a proforma invoice for the advance would result in GST non-compliance.

Example 3: Sale of Goods to a Retailer

Detail | Information |

Business type | Electronics wholesaler |

Product value | ₹3,50,000 |

GST rate | 18 percent |

Delivery status | Goods delivered |

Invoice usage:

- Proforma invoice shared before dispatch for order confirmation

- Tax invoice issued at the time of dispatch

GST charged:

₹63,000 GST added to the invoice and reported in GSTR-1

Key takeaway:

Proforma invoice supports order confirmation, but tax invoice is mandatory for goods movement and GST compliance.

Example 4: Export of Services (IT Consulting)

Detail | Information |

Business type | IT consulting firm |

Client location | Outside India |

Project value | ₹8,00,000 |

GST applicability | Zero-rated (subject to conditions) |

Invoice flow:

- Proforma invoice shared for client approval and foreign remittance planning

- Tax invoice issued after service delivery

Why tax invoice still matters:

Even when GST rate is zero, a tax invoice is required for export compliance and refund claims.

Example 5: Deal Cancellation Before Supply

Detail | Information |

Business type | Event management company |

Event value | ₹2,50,000 |

Status | Client cancelled before event |

Correct practice:

- Only a proforma invoice was issued

- No tax invoice raised

- No GST reversal required

Risk avoided:

If a tax invoice had been issued, the business would have needed to reverse GST and explain the cancellation during audits.

Quick INR-Based Summary

Scenario | Invoice to Use | GST Impact |

Quotation for ₹1,00,000 | Proforma invoice | No GST |

Advance of ₹50,000 | Tax invoice | GST applicable |

Final billing of ₹2,00,000 | Tax invoice | GST applicable |

Deal cancelled | Proforma invoice | No GST reversal |

Indian businesses often lose time and money not because of GST rates, but because of incorrect invoice timing. Using proforma invoices for estimates and tax invoices only when legally required keeps accounting clean, cash flow predictable, and audits stress-free.

Conclusion

The conclusion should clearly tie together practical understanding and compliance responsibility rather than simply summarising definitions. It must reinforce why knowing the difference between a proforma invoice and a tax invoice is critical for Indian businesses operating under GST, especially in day-to-day billing, client communication, and audit preparedness.

Begin by reaffirming clarity. Highlight that confusion between these two invoices often leads to avoidable GST errors, mismatched books, delayed payments, and unnecessary legal exposure. Position correct invoice usage as a business discipline, not just an accounting formality.

Next, encourage businesses to use the right invoice at the right stage of a transaction. Emphasise that a proforma invoice supports transparency during quotation, approval, and advance payment discussions, while a tax invoice is a legal and compliance document that must be issued only when supply conditions under GST are met. Make it clear that timing matters as much as the document itself.

Finally, stress informed decision-making over assumptions. Encourage business owners, founders, freelancers, and finance teams to stop relying on informal practices, templates copied from others, or verbal advice. Instead, they should make invoice decisions based on transaction stage, GST rules, and documentation purpose. Close with a confidence-building message that informed invoice practices reduce disputes, improve cash flow discipline, and protect businesses during audits and regulatory scrutiny.

The tone should remain authoritative yet reassuring, reflecting real-world experience while guiding readers toward compliant, thoughtful, and sustainable business practices in India.

Frequently Asked Questions (FAQs)

The main difference lies in purpose and legal validity. A proforma invoice is issued before the actual sale to share estimated pricing, terms, and scope of supply. It is not a legal demand for payment under GST. A tax invoice, on the other hand, is a legally valid document issued after supply or as per GST rules. It is mandatory for GST compliance and is used for accounting, tax reporting, and claiming input tax credit.

No, GST is not applicable on a proforma invoice because it is not considered a tax document under GST law. A proforma invoice is only a preliminary document used for approval, quotation, or advance discussion. Since no taxable supply has legally taken place at this stage, GST should not be charged or reported. GST becomes applicable only when a valid tax invoice is issued as per the time of supply rules.

An Indian business should issue a proforma invoice when the transaction is still in a discussion or approval stage. This commonly includes sharing quotations with clients, requesting advance payments, confirming order value, or explaining pricing for large or customised orders. Proforma invoices are also widely used in exports and service contracts. They help both parties align on cost and scope before any legal or tax obligation arises.

Issuing a tax invoice is mandatory once a taxable supply of goods or services has occurred or as per the GST time of supply rules. For goods, this usually means before or at the time of delivery. For services, it is generally within the prescribed timeline after service completion. A tax invoice is required for GST reporting, collecting tax from customers, and enabling buyers to claim input tax credit.

No, a proforma invoice should not be used for accounting entries or GST return filings. Since it does not represent a completed supply, recording it in books or reporting it in GST returns can lead to compliance errors. Only tax invoices, debit notes, or credit notes are valid documents for accounting and GST purposes. Using a proforma invoice incorrectly may create mismatches during audits or return reconciliation.

Yes, advance payments are commonly collected based on a proforma invoice, especially in service businesses and large orders. However, once an advance is received, GST implications may arise depending on the nature of supply and applicable rules. In such cases, businesses must issue the required tax document within the prescribed timeline. The proforma invoice itself remains a reference document, not a tax record.

A proforma invoice is not legally binding in the same way a tax invoice is. It does not create a tax liability or enforce payment under GST law. However, it can act as a commercial reference if both parties agree on the terms mentioned. While it helps in setting expectations, legal enforceability depends on underlying contracts, purchase orders, or formal agreements, not the proforma invoice alone.

A tax invoice must include mandatory GST details such as GSTIN of seller and buyer, invoice number, date, taxable value, tax rates, tax amount, place of supply, and HSN or SAC codes. A proforma invoice does not require these mandatory GST fields. It usually contains estimated pricing, product or service description, and validity terms, making it more flexible and informational in nature.

A common mistake is treating a proforma invoice as a final bill and charging GST on it prematurely. Another issue is delaying tax invoice issuance after receiving payment or completing supply. Some businesses also record proforma invoices in accounts, leading to mismatches during GST audits. These errors often arise from assumptions or copied practices rather than understanding GST rules and transaction stages clearly.

Using the right invoice at the right stage helps businesses stay compliant while maintaining healthy cash flow discipline. Proforma invoices support transparent pricing discussions and advance collections without tax risk. Tax invoices ensure proper GST reporting, timely tax payment, and smooth input credit flow for clients. Clear invoice practices reduce disputes, prevent penalties, and build trust with customers, auditors, and tax authorities.